STA are committed to supporting Artists and Creatives to accumulate superannuation. We pay superannuation to contracted artists or arts workers for their labour on top of the negotiated artist fee.

STA pay superannuation contributions quarterly into the super fund nominated by the artist.

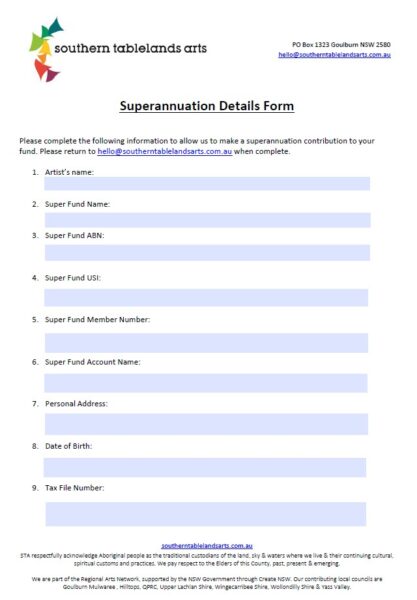

Super can only be paid when an Artist has filled in and returned the superannuation form, so we know where to send the superannuation. DOWNLOAD our Super form NOW. This replaces the Standard Choice form available from the ATO.

This form is required to be filled in by the Artist only once and STA will keep the details on file for subsequent superannuation payments as needed. Another form will need to be supplied if the artist changes to a different superannuation fund.

- Superannuation cannot be paid directly to the contractor.

- The current rate for superannuation is 11% of gross Artist fees (current as of July 2023). Superannuation amounts will increase by 0.5% per financial year until it reaches 12% by 1 July 2025.

Should you expect superannuation as an Artist from other organisations.

Artists who are paid for work under a contract which is wholly or principally (that is, more than 50%) for labour (includes mental and artistic effort) could all be considered employees for the purposes of the superannuation legislation depending on their relationship with the person to whom they provide their services:

- people who receive payment for performing, presenting, participating or providing services in connection with any music, play, dance, entertainment, sport, display or promotional activity, or any similar activity involving the exercise of intellectual, artistic, musical or other creative talents.

- people who receive payment to perform or provide services in connection with the making of any film, tape or disk or of any television or radio broadcast.

Our advice would be to ask about superannuation when negotiating your professional fee.

Further reading

- Find out more at Arts Law Superannuation and contract for services

- The National Association for the Visual Arts has a section on superannuation in their Code of Practice for Visual Arts, Craft and Design

- Visit the ATO for information about the Standard Super Choice form

DOWNLOAD the STA Super form NOW.

This replaces the Standard Choice form available from the ATO.

You may also be interested in the STA Invoicing Best Practise for tips and templates when invoices for creative services.

STA MEMBERSHIP

free & connects you to the STA universe

Reach out to us

[email protected]

0427 938 110

Or by appointment at one of our

Mobile Office locations

PO Box 1323 Goulburn 2580

ABN 67 208 214 681

We acknowledge Aboriginal people as the traditional custodians of the lands where we create, live & work.

© Southern Tablelands Arts. All Rights Reserved

Creatives & Superannuation

Creatives & Superannuation